Who needs a uniform financial statement?

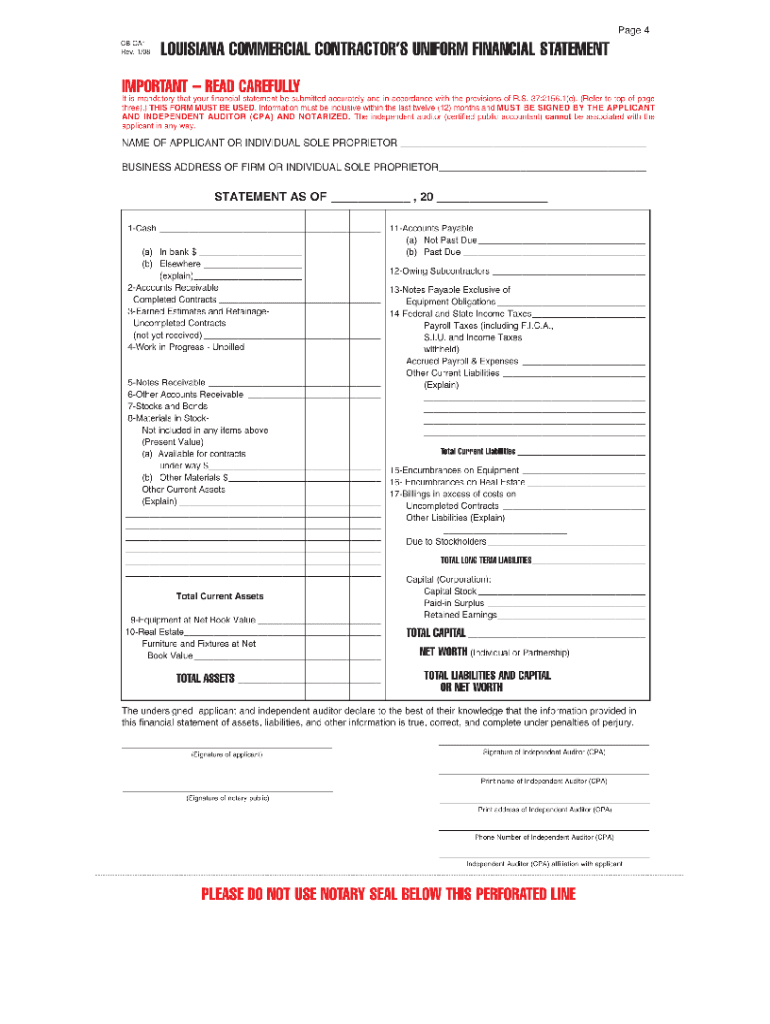

This particular financial statement (CB-CA1 Form) is prepared for the commercial contractors in the State of Louisiana. It has to be filled out by an independent auditor who has no relation to the contractor.

What is this financial statement CB-CA1 for?

It is based upon this financial statement that the employer decides if the contractor is eligible to perform work in the amount that he plans to invest. The contractor has to possess assets of a certain value that, according to this deal, would prove his eligibility.

Is it accompanied by other forms?

A notary public must authorize this statement, but no other forms are required.

When is this financial statement due?

As the contractor’s finances change, he has to provide a new financial statement for every job application. The employer sets the date for filing the application.

How do I fill out the financial statement?

The auditor must write the name and business address of the firm or individual contractor who applies for a job. He puts the date of the statement (the date when he revises the contractor’s finances) and fills in the table to specify the reported finances. He has to include the amount of cash, completed and uncompleted contracts, receivable notes and other accounts, stock and bonds in contractor’s possessions, so he has to count total current assets and total current and long-term liabilities to comprise the total assets and calculate the net worth. On the bottom of the page, the independent auditor must give his name and full address. On the reverse side of the page, the financial institution has to authorize the contractor’s account.

Where do I send the CB-CA1 financial statement?

When the contractor has signed the statement, he must have it notarized and send it to the employer.